(Image source: pixabay.com; Image credit: rawpixel)

(Image source: pixabay.com; Image credit: rawpixel)

When you hear Systematic Investment Plans (SIPs), you immediately associate it to a diligent mode of investing in mutual funds and rupee-cost averaging feature benefit along with the power of compounding to accumulate wealth for a long-term investment horizon.

But before you begin SIP-ping, remember to create a goal-based financial plan considering the investment time horizon of your goal and get your risk profile done. Only after that you choose the best equity fund that would suit your risk appetite and help you achieve your goal faster.

If you are an aggressive investor and have an investment time horizon of more than five years, then you may consider SIP-ping mostly into Small-cap funds. Well, before you make a decision to invest in small-cap mutual funds - note that they aren't for the faint-hearted.

According to the capital market regulator, SEBI, small-cap companies are defined as those that fall beyond the 250th stock in terms of full market capitalization.

A noteworthy trait about small-cap companies is usually due to their low trading volume, the investment risk associated with them is higher than with larger firms. Plus, there is an inherent risk involved due to their limited scale of operations, product lines, narrow distribution channels, limited financial and managerial resources, and greater sensitivity to dynamic economic conditions.

Any adverse economic conditions or any policy changes from the government of greater magnitude can have an undesirable impact on the business of small-cap companies, and in turn on their bottom-line. On the other hand, when the economy is booming and business is on an upswing, small-cap companies do quite well, in terms of revenue growth and profits, and sometimes even outpace the larger companies by a noteworthy margin.

Hence, small-cap mutual fund schemes that invest a minimum 65% of its total assets in equity & equity related instruments of small-cap companies (i.e. companies that are 251st onwards on a market capitalisation basis) have the tendency to go from thrilling highs to dangerous lows.

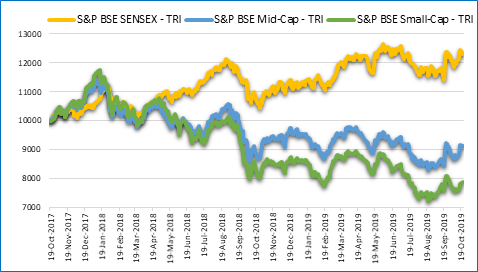

From the graph given below, you can observe the sharp fall and steep rise in the S&P BSE Small-Cap Index since October 2017. In October 2018 the small-cap index witnessed a major beating and continues to be in a corrective phase.

Graph 1: Beaten Small caps. Should you invest?

(Base: Rs 10,000)

Data as on October 22, 2019

(Source: ACE MF)

But, in terms of valuations, the Nifty SmallCap Index is available at P/E multiple of 51.3x, attractive valuation since last year's P/E of 61x. Only a handful of small-cap companies have abled to manage financial stress, and those who pile up massive debt are rarely able to manage repayments when the going gets tough.

Having said that, if you invest in well-managed small-cap funds that pick fundamentally robust companies at reasonable valuations (and have the potential of being tomorrow's large caps), over the long-term (7-10 years) small-cap funds can generate handsome returns for you. But make sure you have the stomach to assume very high risk.

And if you look at the SIP performance of some of the schemes for five years or more, the category average returns have performed better than the Benchmark Index. Even among the worst-performing schemes, besides Canara Rob Small Cap Fund, Quant Small Cap Fund and IDBI Small Cap Fund for a holding period of more than 5 years, small-cap funds have managed to perform in line with the benchmark index.

On the other hand, the best performing schemes have consistently outperformed the benchmark index in the 3-year, 5-year, 6-year and 7-year time frames, respectively.

Table: Performance of SIPs in small-cap funds for varying times

Data as on October 22, 2019

For the calculation, monthly SIP instalment amount of Rs 1000 is considered.

(Source: ACE MF)

*Please note, this table only represents the best performing Small-Cap Funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for an indicative purpose. Speak to your investment advisor for further assistance before investing.

Hence, one can say that in a volatile environment, if you have invested in small cap fund, you must ought to review your investment portfolio to check if its performance is aligned to your investment goal and time horizon.

As amidst the slowdown in economy we are currently in due to the global and domestic concerns, the possibility of continued volatility in the equity markets cannot be ruled out.

Due to sluggish consumption growth, slow transmission of rate cuts, inflationary pressure, capital infusion and PSU bank merger with liquidity concerns, most of the small cap companies will experience turbulence ahead.

So, despite the corrected valuations in the small-cap space that provides the fund managers with the opportunity to do value picking. It remains to be seen how astutely the fund managers will construct the portfolio, and what adequate safeguards will they adopt to control risks your investment could be exposed to in the portfolio in order to not dilute the return potential of a small-cap fund.

Besides, unless you have a very high-risk appetite, stagger your investments with small-cap oriented mutual funds; but don't ignore them totally - make sure to assess your risk appetite first.

Hence, as mentioned earlier, if you do invest via Systematic Investment Plan (SIP) in small-cap mutual funds, this will help you to mitigate the risk due to the rupee-cost averaging feature. Also, invest diligently provided you have an investment time horizon of more than five years.

As a rule of thumb before investing, evaluate the small-cap funds based on its qualitative and quantitative parameters which point out the performance across various across market cycles and phases. The parameters also indicate to the fund houses that have robust systems and processes in place to deal with any market shocks and undercurrents.

Watch this short video on selecting mutual fund schemes:

PS: If you need superlative guidance to select mutual fund schemes that have the potential to provide BIG gains, want to do tax planning with ELSS, and want to know which ones are worthy to start a SIP in, PersonalFN has come up with an exclusive three-in-one combo offer. Click here to know more.

Add Comments