The Association of Mutual Funds in India (AMFI) has been educating investors about the usefulness of mutual funds in one's financial planning for a long time now.

Despite whacky market movements, which you have witnessed of late, retail investors seem to have been holding their nerve.

Systematic Investment Plans (a mode of investing in mutual funds), in particular, are helping investors to mitigate the risks.

Although in the short-run they may not have profited, investors are realizing the benefits of SIP to plan their long-term financial goals viz. children's higher education expenses, wedding expenses, and their own retirement among many others.

Many investment advisers, including PersonalFN––known for providing independent and unbiased research-backed advice––have been advocating SIPs for investors to address long-term financial goals. And it feels really good when years of hard work finally starts bearing fruit.

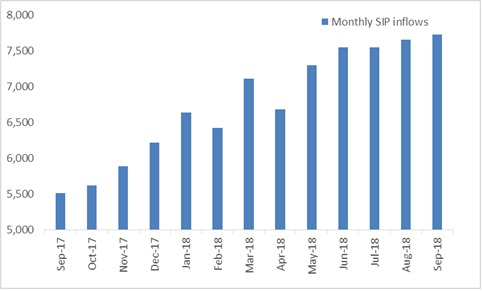

Graph: Investors evincing faith in SIPs

Rs in crore

Data as on September 30, 2018

(Source: AMFI)

As on September 30, 2018, SIP accounts stood at 2.44 crore and the total amount collected through SIPs during September 2018 was Rs 7,727 crore as per the data from AMFI.

As compared to that between April 2017 and September 2017; the quantum of SIPs on a monthly basis has jumped massive 52% for the April-September period in FY 2018-19.

The growth in monthly SIP collections have been moderate this fiscal, but the trajectory is still upwards.

And this is a noteworthy achievement for the Indian mutual fund industry because it denotes that investors aren't keen on cancelling their existing SIPs.

Moreover, investors seem to have realised the importance of asset allocation in one's investment plan.

But will investors lose patience sooner or later? Or have they really (and finally) become mature investors?

The Indian markets are finding support from domestic mutual fund houses and their investors. It is a good thing that the markets are not solely dependent on flows from Foreign Institutional Investors (FIIs).

(Image source: unsplash.com)

(Image source: unsplash.com)

However, historically, it's been observed that the sustained market downturns frustrate investors. They seem to lose patience and then begin to redeem to invest in other asset classes such as gold and real estate, and their all-time favourite bank fixed deposits.

How good is the idea of discontinuing SIPs?

No other idea can be as foolish as this – particularly now, in volatile market conditions.

Be a prudent investor and do not get bamboozled by the short-term aberrations. Focus on your financial goals and make sure you own the best mutual fund schemes in your portfolio.

[Read: Why You Need To Get Your Mutual Fund Portfolio Reviewed Right Now!]

Plus, your asset allocation plays a pivotal role in the journey of wealth creation and accomplishing financial goals.

[Read: Why You Should Not Ignore Personalized Asset Allocation While Investing]

How likely are you going to give up on your SIP?

Here's why one shouldn't discontinue SIPs in falling markets

-

Falling markets allow you to gather more units since the Net Asset Value (NAV) of a scheme falls too. When markets go up, naturally, the NAV rises and you earn high returns on your investments (as you accumulate more units during the downturn).

-

Equity mutual funds are meant for the long term. When you discontinue SIPs in falling markets, you shift your focus from your asset allocation plan and start giving undue attention to market movements. In the short run, sentiments drive markets; but in the long run, fundamentals steer them up or down. In such cases, why not focus on fundamentals and financial goals?

-

When you judge a fund based on its short-term underperformance in a bear market phase, you tend to overlook its long-term track record. A winning mutual fund could be affected during market turbulence, but the magnitude of the fall or its susceptibility needs to be evaluated carefully before you sell in a panic.

[Read: When Is The Best Time To Sell Your Mutual Fund?]

- When you stop SIP and start chasing other assets, you start inviting bigger troubles for yourself and your finances. Simply because there's no guarantee that other asset classes won't disappoint you.

If you wish to calculate the future value of your Monthly SIPs, use PersonalFN's SIP Calculator.

On the contrary, it's good to start SIPs under volatile market conditions for the following reasons:

-

They allow you to beat the market volatility.

-

They end the necessity of timing the market. When markets recover, you don't repent that you didn't take advantage of falling markets.

-

SIPs make you a focused investor and imbibe a sense of discipline of investing regularly.

-

Without committing any big sum to markets, your investments grow steadily and gradually.

[Read: Are SIPs Better Than Lumpsum Investments? Know Here…]

Is perpetual SIP a right option for you?

You can extend your SIPs when they are approaching the end of their tenure. But in contrast, when you keep investing in the same schemes through SIPs for perpetuity, you often overlook their sustained underperformance, if that may be the case.

You must review your mutual fund portfolio once in a while and if a scheme underperforms repeatedly, you should stop SIPs and may even exit entirely.

You should choose the SIP dates intelligently. For example, if you are going to start three SIP accounts in different mutual fund schemes, you can choose three different dates. By doing this, you give yourself a chance to benefit from the price fluctuations.

As against this, when you select only one date or all dates within a particular week, you miss the opportunities created by the market volatility.

Daily SIPs—a good option?

Against daily SIPs, monthly SIPs are convenient. They can be tracked easily and offer higher flexibility. Plus, there may not be a significant movement in daily NAVs to benefit from. Hence daily SIPs isn't a very great option.

[Read: Should You Opt For Daily SIPs In Mutual Funds? Know Here…]

How to choose a right mutual fund for SIP?

Merely investing through SIPs isn't enough though. It's more important to select worthy schemes. Ideally, you should invest in mutual fund schemes that have a proven track record across timeframes and market phases.

To further shortlist schemes, you should rely on the ones offered by fund houses that follow a robust process-driven approach. Those relying excessively on star fund managers lose their path miserably when fund managers leave the organisations.

Editor's note:

If you are looking worthy mutual fund schemes to SIP, PersonalFN is offering you simplest and potentially the best way to identify SOLID mutual fund schemes that can create significant wealth for you. Subscribe to PersonalFN's FundSelect mutual fund research service.

PersonalFN is currently celebrating 15 years of wealth creation for mutual fund investors. Unlock FundSelect anniversary offer here!

PersonalFN's FundSelect has proved to be a time-tested way to beat the market by as much as 70%! Be PersonalFN's FundSelect subscriber today!

Happy Investing!

Add Comments