It’s amusing…

Nowadays if you go to any bank, instead of advising you to open a fixed deposit, the bank personnel are likely to insist you on investing in mutual fund schemes.

All of a sudden, mutual funds are being sold like hot cakes, and everybody in the business wants to have a piece of it.

In the absence of high credit off-take, there’s a lot of cash cash sitting idle in the bank treasuries. Thus, banks are reluctant to raise their deposit base. To discourage depositors, bankers have already slashed interest rates on deposits.

In fact, banks try to push specific mutual fund schemes depending on their “preferred partnership deals” with mutual fund houses. Haven’t you found a specific bank promoting schemes of fund houses promoted by the same group company?

For example, “ABC Bank”# tries to promote schemes of a fund house promoted by “ABC Bank”#. And let’s not point a finger to banks alone. Other advisers also engage in mis-selling depending on the deals they have with mutual fund houses. (#for illustration purpose only)

Although the commission structure has become a flat percent, these days “strategic tie-ups” help banks secure lucrative deals with mutual fund companies. As a result, they end up pushing products that you probably don’t require.

Earlier, mutual fund advisers made investors churn their portfolios unnecessarily to increase the volume of transactions and earn higher commissions. With SEBI’s regulations in place, such blatant malpractices are almost non-existent. But in their place, new forms of soft-mis-selling tactics are showing up their ugly side.

New mis-selling tactics:

- Of late, even conservative investors are encouraged to invest in balanced funds, debt funds, and sometimes even in diversified equity funds.

- Nobody gives a guarantee in writing, but more often historical returns are presented as the minimum returns one can expect from mutual fund schemes.

- Without thorough understanding of the investors’ financial goals, time horizon they want to stay invested, and risk profile, schemes are suggested.

- Advisors, including banks, often refrain themselves from recommending direct plans to investors.

The investors get tricked primarily because they believe the mutual fund distributors and advisers are the same principally. Nonetheless, there’s a huge difference, as you may know.

Who are the advisers?

- Advisers, represent you.

- They always think about getting that are deals beneficial to you.

- Advisers don’t have any monetary or non-monetary business arrangement with the product manufacturers.

- They charge you fees and are accountable for their advice.

Who are the distributors?

- Distributors represent mutual fund houses.

- Although their primary motive is to distribute more mutual funds, they can’t overlook product suitability to their clients.

- Since distributors don’t charge you anything and have monetary arrangements with the fund houses directly, they rarely recommend to invest in direct plans.

Owing to these fundamental differences in the roles of distributors and advisers, the

Securities and Exchange Board of India (SEBI) wants these functions to be separate.

As per the

revised consultation paper issued on

Amendments/Clarifications to the SEBI (Investment Advisers) Regulations, 2013, June 2017, there should be a clear demarcation in the advisory and distribution of mutual funds.

The highlights include:

✔The consultation paper recommends that the investment advisers must always act in the interest of investors.

✔There shouldn’t have any ‘reward’ arrangement with the mutual fund houses.

✔Advisers must consider ‘product suitability’ as the most important factor, when advising their clients on mutual fund investments.

✔They are required to take into account the client’s needs and exercise due diligence.

✔They are expected to demonstrate professional skills and financial-advisory acumen.

SEBI is resolute on pushing for norms in this regard, which may be effective from April 01, 2019.

Although SEBI has proposed to disallow mutual fund distributors from offering investment advice; they can explain the product features to potential investors. Moreover, mutual fund distributors can’t offer any advice on

financial planning. That being said, suitability of the product to the investors is their primary focus.

Before getting investors to invest in a particular scheme, they must sign a form that confirms that the distributor has disclosed the following:

- The list of mutual funds where he is a distributor

- The commission earned or will be received

- Suitability of the product sold to the investor

- Disclaimer that he/she may not be acting in the best interest of investor

SEBI has allowed existing mutual fund distributors to change their goal posts and register as investment advisers, if they wish.

In such a case, they will still be entitled to earn the trail commissions on the mutual fund schemes distributed in the past.

But, they can’t do any businesses as ‘distributors’ once they registered as ‘investment advisers’. Corporate entities interested in carrying out both the businesses—advisory and distribution will strictly have to operate through two different companies—not subsidiaries—for these functions.

SEBI has tried to plug the easily exploitable loopholes. Immediate relatives such as husband-wife, son/daughter-father/mother, among others can’t act as a distributor/sub-distributor and an adviser at the same time.

PersonalFN has always been advocating its readers to take the experts’ help when

selecting mutual fund schemes for the portfolio and prefer direct plans.

To know how to select winning mutual funds watch this video:

What are Direct Plans?

By opting for the

Direct Plan, you eliminate the services of a mutual fund distributor / agent / relationship manager. There is no guidance. You do your own research or bank on mutual fund research reports to invest.

The transactions can be performed online or even physically by visiting the registrar’s or the asset management company’s office. And since, transactions are routed directly; no commissions are paid by the fund house on the money you invest.

Benefits of investing in direct plans

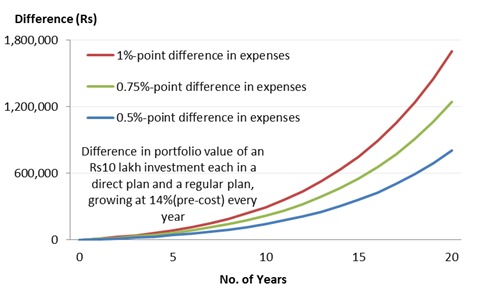

This chart is for illustration purpose only

(Source: PersonalFN Research)

As seen above, the lower expense ratio of a

Direct Plan vis-à-vis a Regular Plan can help you earn better returns over the long run.

Wondering about the regular plans...

This is the conventional kind of plan where you invest/transact through your mutual fund distributor / agent / relationship manager. The recommendations are usually guided by the mutual fund distributor / investment advisor / relationship manager, and there is after-sales support and service.

Indirectly, the commission is paid by the fund house on the money you have invested through the distributors / relationship managers. Hence, due to the distribution cost involved, you incur a higher expenses ratio in a regular plan.

How should you safeguard yourself from mis-selling?

The simplest answer is by investing in direct plans and relying on the advice of a paid-adviser.

The time-consuming and tedious task of selecting the best mutual fund schemes deters many individuals to opt for

Direct Plans. But today, there are a variety of readymade tools to compare funds just at a click and control of the mouse.

Besides, there’s PersonalFN to help you. At PersonalFN, we can power your investment decisions with unbiased research recommendations on mutual funds.

PersonalFN follows a rigorous research process to help you, investors, select the best mutual fund schemes for your investment portfolio.

At PersonalFN, along with quantitative parameters such as performance, qualitative parameters such as portfolio characteristics are also considered while analysing mutual fund schemes. With over decades of experience, PersonalFN has put together a research report on potentially the best mutual fund SIPs for your long-term portfolio —

The Super Investment Portfolio – For SIP Investors.

Under this, we conduct a detailed analysis on how SIPs in the top shortlisted mutual fund schemes have performed, across multiple market conditions and timeframes. Only those funds that successfully pass this evaluation are chosen.

Don’t miss out on early bird discounts. Subscribe to the report here.

For investors looking for readymade solutions, there’s PersonalFN’s

FundSelect Plus, a comprehensive portfolio service to benefit from SEVEN time-tested, readymade equity and debt mutual fund portfolios. Based on your risk profile and investment horizon, you can choose from three equity portfolios and three debt portfolios. In addition, you get a readymade tax-saving portfolio as well. This service has a decade-long market-beating track record.

Don’t miss out on exclusive discounts available, subscribe now!

Some may ask, “Why can’t I simply go by star-rated mutual funds?” Well, you could begin there –a good starting point, but it is inconclusive. PersonalFN is of the view that you as an

investor should not blindly go by star ratings.

Attempt to delve deeper into understanding the methodology used for rating funds. Often the highest weightage is assigned to the recent performance and only quantitative parameters are considered for rating funds.

As a result, you find a five-star fund pushed down to a three-star or two-star, few months down the line. In our view, both quantitative and qualitative parameters need to be judge to rate mutual fund schemes. Qualitative parameters form an inseparable part of the analysis of mutual funds, while the quantitative parameters form only the outer layer of a scheme. Qualitative parameters are able to produce more robust ratings as it takes into account a host of factors, viz. fund manager’s experience, number of scheme to fund manager ratio, the proportion of AUM performing, unique scheme, and investment processes & systems followed by the mutual fund house.

If you require some handholding in the path to wealth creation, with a customised investment portfolio, and need a financial plan in place; seek guidance from our Certified Financial Guardian who can guide you in an unbiased, objective manner.

Schedule a call with our Financial Guardian here for superlative guidance. Our ‘financial guardian’ will help you build a portfolio considering your risk appetite, investment objectives, investment horizon, and financial goals. He/she will help you manage your hard earned money with as much care as they manage their own.

At PersonalFN, we put your, the investor’s, interest before our own, recommend

Direct Plans to invest in mutual funds, and follow high fiduciary standards. So, naïve investors can consider opting for

PersonalFN’s services.

The time has come to ask yourself and judge: Are you compromising on long-term returns for a little comfort in the short-term by availing services of mutual fund distributors, or is there a real value?

Similarly, when investing online through robo-advisory platforms, make sure they are transparent and you are getting best advice before it’s too late.

|

Try our SIP Calculator to find future value of your SIP contributions.

|

Add Comments