(Image source: Image by Vitabello from Pixabay )

(Image source: Image by Vitabello from Pixabay )

Divestment is the opposite of investment, basically dis-investment. In finance, when a firm or company wants to raise funds or maximize the value of the parent company, a unit/part of the company / a subsidiary is sold off.

In India, to raise funds, the government started with divestments of Public Sector Units (PSUs) to a private sector or any individual in 1991, and a department (now Department of Investment and Public Asset Management) was set up under Ministry of Finance to complete the projects successfully.

-

The PSUs are divided into strategic and non-strategic. Strategic included railway, arms - ammunition, energy, etc. Non-strategic included others that were not part of the above category.

-

Along with NITI Aayog (Think-tank to recommend) for disinvestment the PSUs are selected.

-

The sale proceeds from divestment are deposited in National Investment Fund.

Initially only 20% of selected PSUs would be divested, whose limit gradually increased to 49% by 1993. And now this year in the maiden budget speech, finance minister, Ms Nirmala Sitharaman, laid a path for the future course with the endeavour to make India a US$ 5 trillion economy by 2024-25. And in the projected plan, she mentioned about the PSU sector:

"The minimum public shareholding in listed companies will be increased from 25% to 35%. A new electronic fund-raising platform will be created for listing social enterprises and voluntary organisations. The present policy of 51% stake of government in non-financial PSUs will be modified to include the stake of government-controlled institutions. Also, there will be disinvestment in Public Sector Undertakings (PSUs) with a target of Rs 1,05,000 for 2019-20."

The other big announcement Ms Sitharaman made later in August 2019 was the merger of 10 PSU banks to 4 banks. It is well-intended and purposeful to facilitate efficient use of capital and could result in reducing NPAs.

The bank merger decision was taken after the government's successful merger of SBI by combining its five associate banks and Bhartiya Mahila Bank to form a single entity last year.

The PSU banks to be merged are:

-

Punjab National Bank, Oriental Bank of Commerce, and United Bank of India will combine to form the nation's second-largest lender;

-

Canara Bank and Syndicate Bank will merge;

-

Union Bank of India will amalgamate with Andhra Bank and Corporation Bank;

-

Indian Bank will merge with Allahabad Bank.

Ms Sitharaman also announced a raft of governance reforms aimed at making public sector banks more independent and accountable. Further on October 4, 2019, the cabinet approved the new process of strategic disinvestment to privatize selected PSUs.

[Read: How Nirmala Sitharaman's Recent Announcements Impact the Mutual Fund Industry]

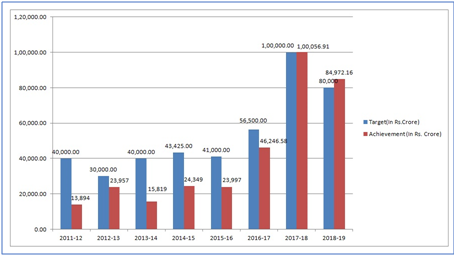

But speaking of PSU disinvestments, the government track record has failed to achieve the actual target of disinvestment. As per the data released from DIPAM, it has been missed most of the time, as seen below.

Graph 1: Historically, PSU disinvestments, missed most targets

(Source: Department of Investment and Public Asset Management (DIPAM))

(Source: Department of Investment and Public Asset Management (DIPAM))

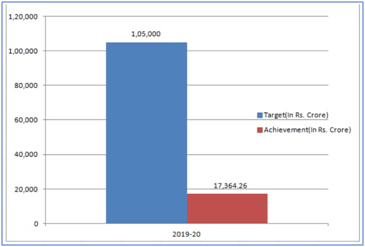

And even for the current year, the target is likely to be missed; due to liquidity concerns in the current continued economic slowdown, many buyers aren't available in the market to absorb the stake sale. Besides, many PSUs aren't available at fair valuations that make a very compelling investment proposition.

[Read: Here's Why Slowdown Is The Best Time To Invest In Actively Manage Equity Mutual Funds]

Graph 2: Current fiscal's disinvestment target likely to be missed.

For the current year, the target set is of Rs 1,05,000 crore and so far, the government has achieved Rs 17,364.26 crore.

(Source: Department of Investment and Public Asset Management (DIPAM))

For the current year, the target set is of Rs 1,05,000 crore and so far, the government has achieved Rs 17,364.26 crore.

(Source: Department of Investment and Public Asset Management (DIPAM))

So, then as an investor, you need to asky yourself, is it worth investing in PSU Sector Funds?

To reiterate, investment has to be done based on your individual needs, requirements, investment timeline, financial position and the amount of risk you are willing to take. Every investment avenue carries some level of risk, and equity mutual fund investment carries the highest amount of risk.

Within the equity universe, sectoral/ thematic funds are the riskiest, particularly when bets in case of most others are at odds, and the PSU funds are sectoral funds.

Remember, the fortune of a thematic fund is closely linked to how the underlying theme and stocks held in the portfolio perform. However, it would be incorrect to stay away from well-performing PSUs that are worth the investors' hard-earned money.

That being said, the fact is that PSU companies, irrespective of market cap segment and the industry they operate in, are largely driven by policies and regulations of the government. This can deeply impact the fund holding it, and if the PSU fund is not managed well, it could do more harm than good if you hold it in the investment portfolio.

Hence, avoid adding a PSU Sector Fund to your portfolio if you're averse to extreme-high risk; it would be wiser to consider a worthy diversified equity fund/s that sensibly invests in well-deserving PSUs along with other sectors/themes. This will counter the downside risk of loss of hard-earned money and help achieve your investment objectives.

Besides, some worthy diversified equity funds have outperformed their respective benchmark index as well as certain sector/thematic funds, if you assess and select them based on quantitative and qualitative parameters.

[Read: Worthy Mutual Funds To Decide Your Investment Success In 2019]

Remember, the art of cleverly structuring the portfolio starts by assigning weights to each category of mutual funds and the schemes picked for the portfolio is extremely important so that you can earn optimal risk-adjusted returns. Plus, don't forget to periodically review your investment portfolio.

Happy Investing!

Editor's Note: Do wish to invest in top-quality, well managed mutual funds that come with solid long-term potential and build wealth with tested mutual fund portfolio strategies? Get two of our most promising services FundSelect and FundSelect Plus in this mega combo offer.

Our special research reports can help you with some great picks of our research team and provide a boost to your investment strategy.

Subscribe now!

Add Comments

| Comments |

Bhagirathmalkaswan175@gmail.com

Dec 04, 2019

Yes please let me know when you're ready free of charge for a best friend so wats numar sent you |

1