An ELSS, also known as a tax saving mutual fund, are diversified equity funds that offer a tax benefit under Section 80C (up to Rs 1.5 lakh). A distinguishing feature about ELSS is that they are subject to a compulsory lock-in period of 3 years, but the minimum application amount in most of them is as little as Rs 500, with no upper limit.

SLTEF is one such tax saving scheme that offers a dual benefit of tax rebate and capital appreciation from a diversified portfolio of predominant investments made in equity and equity-related securities. SLTEF will invest more than 80% of its total assets in equity and equity-related securities. So, from a risk-return standpoint, SLTEF is a high risk-high return investment proposition.

In the long-term, if you intend to create wealth, then a tax saving fund such as SLTEF could potentially clock luring inflation-adjusted returns if the portfolio construction is done astutely and risks are managed well. But remember, there is high risk. Hence, before you invest recognise your risk profile and make sure you have an investment time horizon of at least 3 years.

You can do either lump sum investments or investments through a Systematic Investment Plan (SIP). In the case of the latter, each instalment has a 3-year lock-in period. Both individuals and HUFs are entitled to invest in ELSS.

Table1: NFO Details of SLTEF

| Type |

Open-ended equity scheme with a statutory lock-in period of 3 years and a tax benefit |

Category |

Equity-linked saving scheme |

| Investment Objective |

To generate income and long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities and enable investors to avail the income tax rebate, as permitted from time to time. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 500 and in multiples of Rs 500 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Regular

• Direct

|

Options |

• Growth (default option)

• Dividend Payout

|

| Entry Load |

Nil |

Exit Load |

Nil |

| Fund Manager |

Mr Kartik Soral |

Benchmark Index |

NIFTY 500 |

| Issue Opens |

December 17, 2018 |

Issue Closes: |

January 18, 2019 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, it is anticipated that the asset allocation of the scheme will be as follows:

Table 2: SLTEF’s Asset Allocation

Instruments |

Indicative allocations

(% of Total Assets) |

Risk Profile |

| Minimum |

Maximum |

| A. Equity and Equity Related Securities # |

80 |

100 |

Medium to High |

| B. Debt & Money Market Instruments # |

0 |

20 |

Low |

# including Derivative instruments.

#Debt securities shall be deemed to include securitised debts (excluding foreign securitised debt) and investment in securitised debts shall not exceed 50% of the debt component of the Scheme. Investments may be made in foreign debt securities not exceeding 20% of the debt component of the Scheme. However, investments made in foreign debt securities would not include investment in foreign securitised debt. All investments in foreign securities shall adhere to SEBI circular SEBI/IMD/CIR No.7/104753/07 dated September 26, 2007, and amendments thereto.

Investments may be made in GDRs/ADRs not exceeding 20% of the net assets scheme.

(Source: Scheme Information Document)

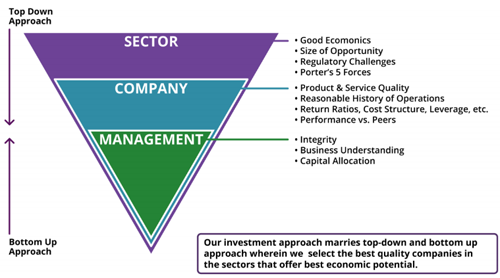

What will be the Investment Strategy?

Shriram Long-Term Equity Fund will try to generate superior returns by investing in equity and equity-linked instruments across the market capitalisations. It will use a bottom-up approach to select stocks while constructing its portfolio. For risk mitigation purpose adequate diversification will be followed by spreading investments over a range of industries and companies.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

The investment strategy of the AMC is directed toward investing in stocks, which, in the opinion of the Investment Manager, are priced at a material discount to their intrinsic value. Such intrinsic value is a function of both past performance and future growth prospects.

The process of discovering the intrinsic value is through in-house research supplemented by research available from other sources. For selecting particular stock as well as determining the potential value of such stocks, the AMC is guided, inter alia, by one or more of the following considerations:

-

The financial strength of the companies, as indicated by well recognised financial parameters;

-

The reputation of the management and track record;

-

Companies that are relatively less prone to recessions or cycles, either because of the nature of their businesses or superior strategies followed by their management;

-

Companies which pursue a strategy to build strong brands for their products or services and those which are capable of building strong franchises;

-

Market liquidity of the stock.

Image 1: Equity Investment Approach

(Source: Shriram Long-Term Equity Fund Presentation)

The Scheme is not restrained from investing in listed/unlisted and/or rated/unrated debt or money market securities, provided the investments are within the limits indicated in the asset allocation pattern.

The Scheme may also invest in GDRs/ADRs, if and in the manner permitted by SEBI/RBI. Such investments will be in conformity with the investment objectives of the Scheme and the prevailing guidelines and Regulations.

Who will manage Shriram Long-Term Equity Fund?

The Fund will be managed by Mr Kartik Soral, a senior fund manager at the fund house.

Mr Soral has to his credit a Bachelor's degree in chemical engineering-- B. Tech Chemical Engineering (from IIT-BHU, Varanasi), a PGDM from IIM-Ahmedabad, and is a Chartered Financial Analyst (CFA).

Mr Soral has more than nine years of work experience. Before joining Shriram Mutual Fund he was a Fund Manager at Edelweiss Asset Management Co. Ltd for more than three years. Prior to that, he was associated with Larsen & Toubro and Deutsche CIB Centre and had held key positions in the Corporate finance & Global Equity Derivatives department respectively.

Currently, at the fund house, he manages Shriram Hybrid Equity Fund and Shriram Multicap Fund.

The outlook for Shriram Long-Term Equity Fund:

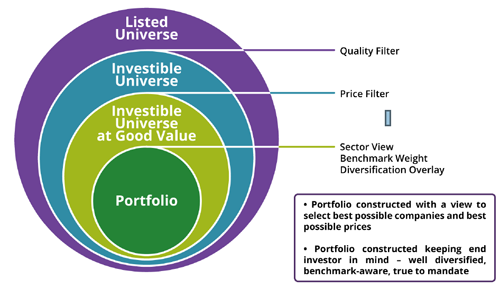

In the presentation Shriram Long Term Equity fund mentions, “that an investor values steady market-beating returns more than the returns that oscillate between the top quartile in good times and the bottom quartile in bad times”.

Hence the portfolio construction will be such that, it aims to generate the long-term returns, and for that, the manager will actively manage the fund to capture the best possible business entities at its intrinsic prices. And handle the risk efficiently to preserve the capital as well.

Image 2: Portfolio Construction Overview

(Source: Shriram Long-Term Equity Fund Presentation)

Being an equity-oriented scheme, as mentioned earlier, SLTEF will be a high risk-high return investment proposition.

In the current environment, although the global cues have been positive and proved supportive for the Indian equity markets along with cool-off in oil prices and rupee appreciation, there is still uncertainty looming: due to loss in economic growth momentum, the loss suffered by BJP in three states, we are just a few months ahead of Lok Sabha elections, and RBI’s autonomy is questioned, and many other factors.

During such times, volatility will be obvious and therefore constructing the portfolio will not be an easy task for the fund manager. The fortune of the SLTEF will be closely linked to how well the fund manager and his team assess the scenario and risk management measures they adopt.

To read PersonalFN’s view click here.

PS: If you need superlative guidance to select mutual fund schemes that have the potential to provide BIG gains, want to do tax planning with ELSS, and want to know which ones are worthy to start a SIP in, PersonalFN has come up with an exclusive three-in-one combo offer. Click here to know more.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited ;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Rahul Goel;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a company on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Definitions of Terms Used

-

Buy recommendation: This means that the subscriber could consider buying the concerned fund keeping in mind the tenure and objective of the recommendation service.

-

Hold recommendation: This means that the subscriber could consider holding on to the fund until further update. However, additional purchase via ongoing SIP can be considered.

-

Sell recommendation: This means that the subscriber could consider selling the fund keeping in mind the objective of the recommendation service.

Click here to read PersonalFN’s Mutual Fund Rating Methodology

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments