When travelling on the local trains in Mumbai city, most commuters prefer the fast train and will battle through the rush just to catch it. Now the travel time difference between a slow train and the fast one is 10 minutes. Basically, a fast local from Borivali to Churchgate takes around 60 minutes and a slow train on the other hand takes around 1 hour 10 minutes.

In a city where time is money, saving those 10 minutes to reach their destination by skipping many stations matters a lot to Mumbaikars.

Similarly, mutual funds offer two plans – regular plan and direct plan.

And as the name suggests, direct plans get you to invest in mutual funds directly without the middle-man (adviser/distributor).

The transaction can be done online or by physically visiting the registrar’s or the asset management company’s office.

Regular Plan on the other hand is the conventional way. Through this mode, you push your request to transact vide the mutual fund distributor / agent / relationship manager.

Why is it beneficial for you to choose direct plans?

Direct plans offered by mutual funds make a positive difference to your investments every year. The direct plans generate roughly 0.5% to 1.0% additional returns every year. However, if you sow the seeds of these small savings, you could harvest rich rewards over a tenure of 15-20 years — thanks to the power of compounding .

And in this article, I will elucidate why and how even a 0.5% - 1% difference can make a considerable difference on your investments.

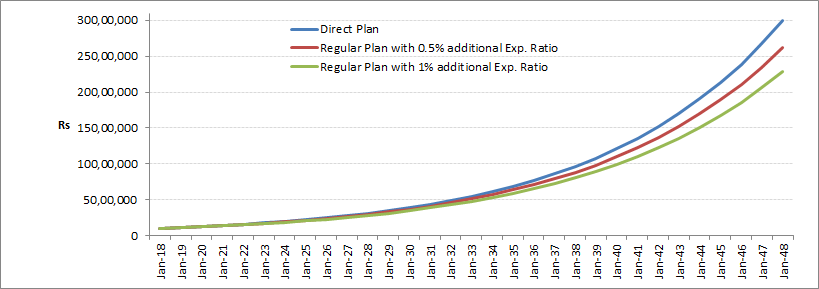

For instance, in the chart below, Rs 10,00,000 is invested in Direct Plan and regular plan assuming 0.50% and 1% difference in the expense ratio.

Note: The above chart is for illustration purpose only

(Source: PersonalFN Research)

The table below demonstrates how small savings of 0.50% or 1% in the expense ratio over 30 years can make a huge difference, assuming the returns clocked are 12% compounded annualized.

|

Direct Plan (in Rs) |

Regular Plan with 0.5%

additional Exp. Ratio (in Rs) |

Regular Plan with 1%

additional Exp. Ratio (in Rs) |

| Initial Investment |

10,00,000 |

10,00,000 |

10,00,000 |

| Value After 30 years |

29,959,922 |

26,196,666 |

22,892,297 |

You see a slightly conservative estimate, considering the difference in the expense ratio would be just 0.5% every year, suggests that the excess money you would make in this 30-year timeframe would be over Rs 26 lakh.

And on the other hand the value of same amount invested in a regular plan with 1% difference would be around Rs 22 lakh.

So,even a 1% lower expense ratio makes a good difference of Rs 7 lakh .

Now investing in direct plans sounds promising; doesn’t it?

Here’s another benefit of investing through direct plans. You avoid commission-driven distributors and agents who often misguide you. This gives you the opportunity to do your research on the investment options available.

In truth, many investors find this job very tedious and time-consuming. If this has been your reason for not investing, it’s time to re-examine.

But, trust me, it isn’t that difficult. You can become your own financial advisor on completing this e-course - A Comprehensive A To Z e-Course To Become Your Own Financial Planner. To know more click here.

Alternatively, you can always approach an independent mutual fund adviser who offers an unbiased research-based view for a fee, and you’re always free to invest in a direct plan.

For your long-term financial wellbeing, it is essential that you review your portfolio so that corrective measures can be taken at the right time.

The time has come to ask yourself and assess: Are you compromising on long-term returns for a little comfort in the short-term by availing services of mutual fund distributors, or is there a real value?

(Image source:freeimages.com)

If you decide to invest in mutual funds directly, here are the different paths:

Asset Management Company

You can visit the nearest AMC office or its website to invest in the mutual fund. You could invest in mutual fund schemes directly through the online portal of the Asset Management Company.

Registrar & Transfer Agent (R&TA)

The registrars also facilitate online investing in mutual funds, however, the investment will be limited to the mutual funds registered with them.

You can either visit the CAMS or Karvy website and invest in schemes of your wish.

Mutual Fund Utilities

Mutual fund transaction portal, MFU (Mutual Fund Utilities) is a single window for you to transact across mutual fund schemes.

Mutual Fund Utilities is a shared platform of different fund houses. You need to create an account first, before transacting and you can transact in mutual funds of almost all the AMCs. Using a Common Transaction Form (CTF) or through the online portal you can invest in multiple funds of different fund houses.

Robo-Adviser

Robo-advisers are digital advisers that provide portfolio management and financial planning services online, without any human intervention. These types of advisers are usually more affordable than human advisers to all classes (of investors). The advantage with robo-advisers is zero human bias in the advice.

Especially the one’s which offer direct plans only.

Direct Plans are convenient and cost-efficient avenues to invest.

Though regular and direct plans follow the same investment strategy, objective, portfolio, and fund manager, the major difference is expense ratio.

And you cannot afford to ignore this 0.5% difference because, in the long run, this will make a significant difference on the potential to build wealth.

Read: How To Invest In Direct Plans of Mutual Funds Online & Offline

Just like saving those 10 minutes is crucial for Mumbai train commuters, a 0.5% difference is crucial for your long-term investments.

And if you are looking for the best robo adviser, then let me tell you that best is yet to come.

We are launching PersonalFN Direct, our highly awaited Robo Adviser, on the July 02, 2018.

We care for your hard-earned and hence our robo advisory platform will offer only direct plans.

And if our calculations are not wrong, it has the potential to make you additional gains of as much as Rs 30 lakhs in 30 years!

You can sign up for it right away and become a FOUNDER MEMBER with a “Never Before, Never Again offer”

PS: We will only be accepting 1,000 sign ups under this FOUNDER MEMBER offer.

YES, MAKE ME A MEMBER NOW!!

Add Comments