(Image source: Image by Nattanan Kanchanaprat from Pixabay)

(Image source: Image by Nattanan Kanchanaprat from Pixabay)

Kumar cared and planned for his future as he did with his present. When he began earning, he invested in mutual funds to secure his future. He was sure that regular investments in mutual funds via Systematic Investment Plans or SIPs would help him achieve all his financial goals.

Now six years later, Kumar considered buying a car. He believed that the accrued value of his mutual fund investment portfolio would aid him to purchase the car of his choice as he had been investing a substantial amount via SIPs in mutual funds for over a fairly long period of time. He was of the view that his dream of owning a car was finally going to come true.

However, when he reviewed his portfolio to check which model he could afford, he faced a shocking truth. Despite having invested a good amount regularly over a long period, his investment had grown, but the growth was below expectations, to say the least.

Kumar was devastated because he would have to delay buying the car. He wondered where he went wrong!

So where did he go wrong?

The answer is simple.

Kumar kept investing for his future goals, but he had never clearly defined his goals.

More importantly, he never tracked the performance of the mutual fund schemes he invested or assessed whether they were suitable for him.

Many investors, like Kumar, are ignorant about the performance of their mutual fund portfolio. You could be one of them and you probably will never come to know about this until it's too late. The awakening generally happens when your portfolio isn't making much money or keeps on incurring losses month after month and you miss out on the timeline of your goals.

However, don't worry; there is a simple solution to stop that from happening.

The solution is to review your mutual fund portfolio regularly.

The aim of mutual funds is to outperform its benchmark and provide you with better returns - generate an alpha. Your investment should be able to give reasonable returns over a long period. And if the fund has not been able to achieve that over time, then it warrants your attention --calls for pruning and weeding out the duds to replace them with better and well-deserving schemes to ensure you are on track to accomplishing your financial goals.

The equity markets, of course, go through bull and bear market phases, and sometimes even moves sideways. That said, you need to evaluate the performance of the mutual fund scheme across market conditions.

[Read: Why To Evaluate Mutual Fund Performance Across Bull And Bear Market Conditions]

Further, do note that star-rating of the funds is not always indicative of their future performance.

What's more?

As years pass, our personal and professional circumstances undergo various changes. You might get married, have children, take your family out on a foreign tour, might lose your job, start your own business, or plan an early retirement and so on. All this leads to a change in your goals, risk appetite, asset preference, and time horizon.

Thus, your portfolio may warrant a change to accommodate your new goals and financial circumstances. You may have to shift some portion of your allocation from equity to debt or vice versa. The amount of money and time horizon you will need to achieve your goals might change. This is another reason why you need to review your investments timely.

Another problem that ails investors is over-diversification. Diversification is of one of the basic tenets of investing and ensures the health of your portfolio while you endeavour to accomplish your financial goals. But overcrowding your investment portfolio is not the right thing to do; in fact, it may do more harm than good. You will not be able to take full advantage of the growth in any of the category by over-diversifying.

There are many examples of investors holding more than 10 funds in their portfolio. Ideally, there should not be more than 5-7 funds in your portfolio and those funds should not be of the same category.

[Read: Best SIPs To Invest in 2019]

How frequently should you review your portfolio?

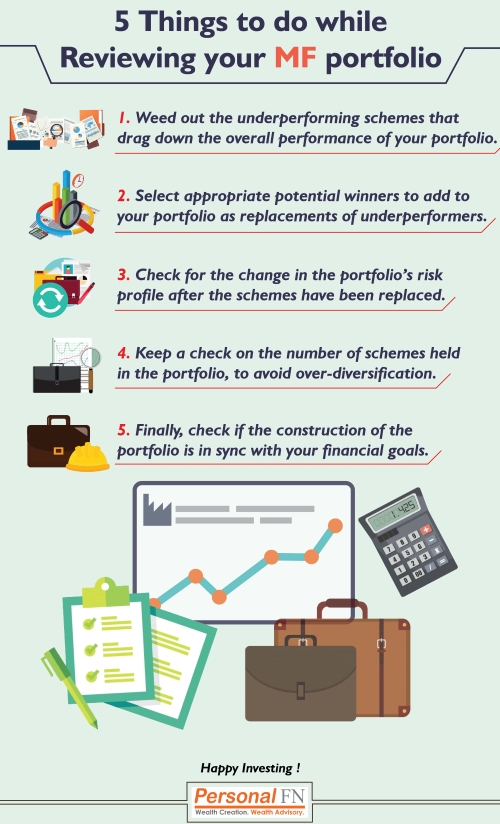

You need to review your investments at least once a year. While reviewing, check the following points:

-

Your fund is performing well across market phases

-

Your investments are not too concentrated to a fund house, a respective category, subcategory

-

The overall risk the portfolio is exposing you to

-

Is the portfolio optimally diversified or over-diversified

-

Are your investments well-aligned to your risk profile, investment objectives, financial goals, and time horizon before goals befall

Here are four key benefits of reviewing your mutual fund portfolio:

-

Helps to identify underperformers

-

Find suitable alternative mutual fund schemes

-

Facilitates optimal structuring of the portfolio

-

Aligns your portfolio to ensure you are on track to accomplish your envisioned financial goals

Lastly, do note that there can be a lot of fluctuations in the short-term. Therefore, reviewing your portfolio too often, over a short span of time, may not be a sensible idea. Focus on the long- term. Be prudent and patient to gain the most out of your investments.

Editor's note: To ensure that volatile market conditions aren't taking a toll on your financial goals, I strongly recommend that you avail of PersonalFN's Mutual Fund Portfolio Review service.

Through this service, our investment advisor will provide personalized attention to you by reviewing your existing mutual fund investments, and also recommending the future course of action.

With our well-analyzed recommendations, creating an optimal mutual fund portfolio will be a piece of cake for you.

Add Comments